The big news recently revolves around KREIT’s handling of the OFC purchase. The ramification of that is a lot of the blogging community starts talking that its about time MAS took notice of it.

My take? About time. I first got to know about this when my friend passed me this damning analysis from an independent analysis on the REIT scene in Singapore. Back then (3 years ago), the analyst raised the same thing about Singapore REITs

- Trustee Fees, Management Fees and Sales Fees means that it doesn’t matter how much cash flow the REIT produce for investors, they still make money.

- The sponsors have a great incentive to dump assets in their REITs. It’s a win win for them.

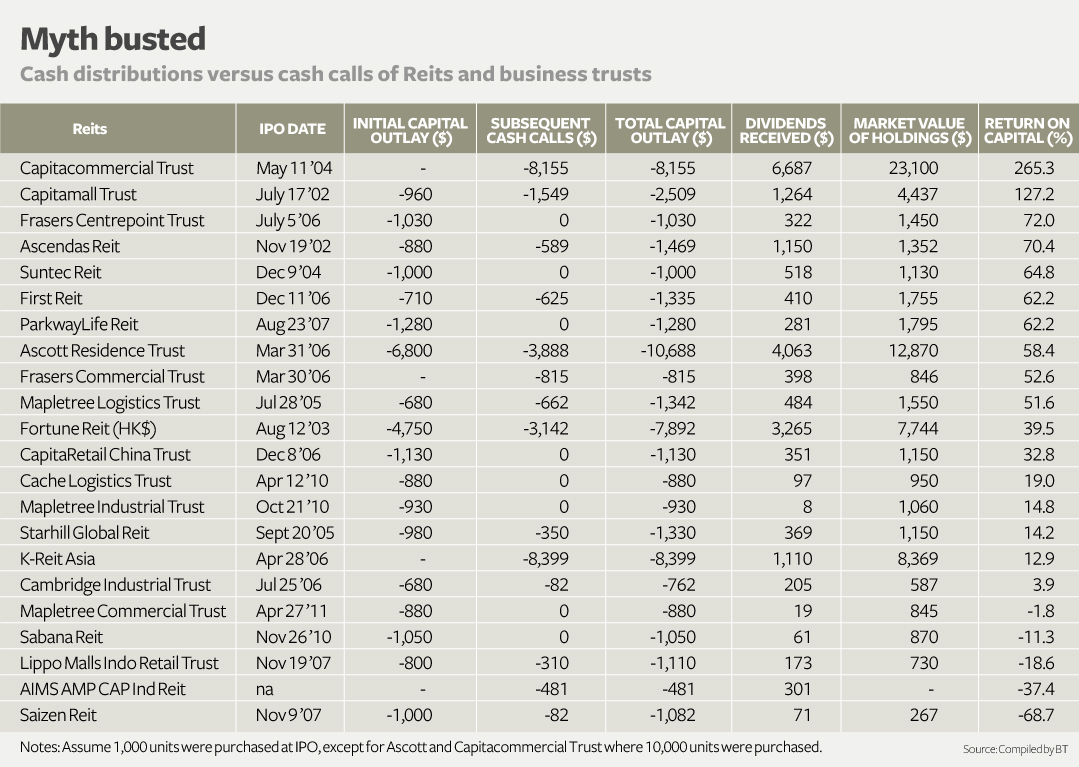

Ms Teh Hooi Leng had an article today in Business Times that took a look at all cash calls of the REITs listed in Singapore. For the full article you can read them for free at night at the Business Times [Article here >>]

Here’s the table in the article

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

A J

Wednesday 7th of August 2013

If I am trying to calculate Free Cash Flow of a reit how would I do it?

Kyith

Wednesday 7th of August 2013

actually usually what is reported in a REIT is pretty good. Just take the income without adjusting to fair valuation.

alternatively go to cash flow statement and look at the net operating cash flow.

G

Sunday 27th of November 2011

Its an interesting article - and it is quite clear that a simple buy-and-hold strategy for passive income for REITs isn't going to work.

And I do agree with Drizzt's point on the avenues available for REITs to raise cash - but there is a third option - that is to sell existing assets to buy other assets in a DPU-accretive manner. Existing assets can also be enhanced to improve property yield hence increasing its valuation.

I wonder if the same analysis can be repeated, but all adjusted for nett zero cash flow. And how would the capital gains for each REIT would be like.

An example would be that the investor sells its nil-paid rights awarded to him/her and uses the capital to re-invest into the mother shares. Same goes for the dividends.

Or another method would be to assume a "return OF capital" on all rights issues and do a cash flow analysis on that instead...

Wonder how the results would turn out...

Drizzt

Sunday 27th of November 2011

Thanks G all good questions and i think i would need a hell of a time calculating that.

Gregg

Sunday 27th of November 2011

Hi Francis,

Avoid shipping trust, i am in the deep sh*t for FSL Trust....

Drizzt

Sunday 27th of November 2011

not all shipping trust are bad. FSL is a problem though. but they might be coming out of it.

Francis

Sunday 27th of November 2011

Thanks for the reply.. in that case, which 3-4 Reits in your portfolio tracker would you consider best the the newbie investor and which 3-4 reits would you advise to avoid.. going forward from the present economic environment? Don't worry, I won't blame you for anything.. just wanted your thoughts on this! Thanks..

Drizzt

Sunday 27th of November 2011

hi Francis, that is difficult to provide since i do not know how much risk u can stomach. the better reits would be plife and first reit due to the nature of assets being defensive. frasers centerpoint, ascendas reit, MLT and MIT are not bad as well.

Drizzt

Sunday 27th of November 2011

Hi Francis, there are those older REITs that did well.

What Ms Teh want to say is that cash calls show bad money management for REITs but in my opinion the REITs have only 2 ways of gaining more avenue for cash: debts and cash calls.

Non-REITs can choose not to pay out such a high dividend payout and use the cash to pay down debts or do asset enhancement, REITs cannot.

This situation should have been better regulated by MAS. It is like the insurance industry taking advantage of policy holders. They can say you earn reasonable bonus but in effect we are peeved because that is not how to align the interests of policy holders. Same in this situation.