One of the great resource that provides sound wealth advice from America have been a blog called A Wealth of Common Sense and Ben Carlson wrote a good piece that I would like to bring to your attention.

Ben talks about how often the narrative when it comes to rising interest rates means holding bonds is not cutting away the cancer when the story seldom put enough light on the lower volatility nature, total return, and the role in a portfolio:

What resonates with me the most is this paragraph:

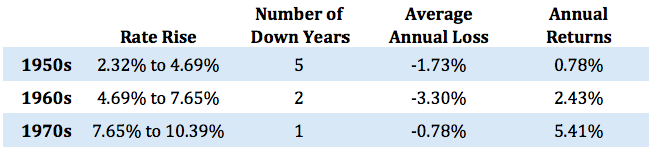

This is one of the reasons that average investors (and let’s be real, many professionals) are so confused about the mechanics of bonds. Yes, rising interest rates means lower bond prices. But it doesn’t necessarily mean lower bond total returns. Remember, to earn better long-term returns in bonds we need to see higher interest rates eventually. When yields rise you start to earn more income. That’s a good thing.

Some time ago, I try to bring to light the need to have the same focus on total return, instead of just looking at bond prices. (Read it here)

If the newly release bonds are going to be higher yielding (and not just in theory) then a bond fund or ETF, with a mandate to keep till maturity and using the proceeds to buy a higher yielding bond should give you a higher interest yield over time, thereby giving a good total return.

Its a good read and I urge you guys and gals to read it and not just think “oh shxt! interest rate is going to rise from 0% to 15% and my bonds are going to be worthless!”

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

smk

Saturday 20th of February 2016

will take very long for "investment grade bonds" to be attractive to me to vest in. or it might not happen. not saying it won't happen, maybe it will or maybe it won't.

but to the average investor, not likely to be good enough in valuing junk bonds to invest in them.

gv

Thursday 4th of February 2016

Great stuff Kyith, it make sense, I guess the returns derive from rebalancing of bond portfolio to capture the raising interest rate.

Kyith

Thursday 4th of February 2016

hi gv, not so much a rebalance but just a systematic reinvestment