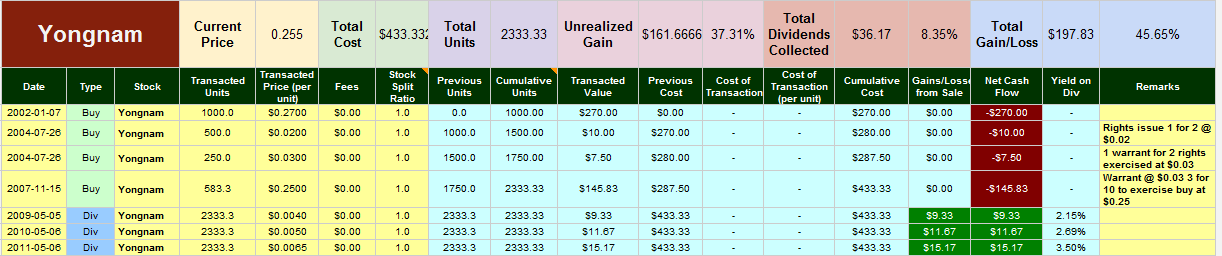

My friend liked my spreadsheets a lot and was wondering how one of his favorite stocks would do for the past years.

So I did up my spreadsheet to see what would your returns be if you have held since 2002.

Yongnam have always been a stalwart in Singapore’s construction scene but the construction industry too a really bad dive in the 2001 and 2002 period. I still remember how construction completely dried up due to HDB taking a different stance as in the past they would just build and build and build flats, they decide to shift to a BTO concept.

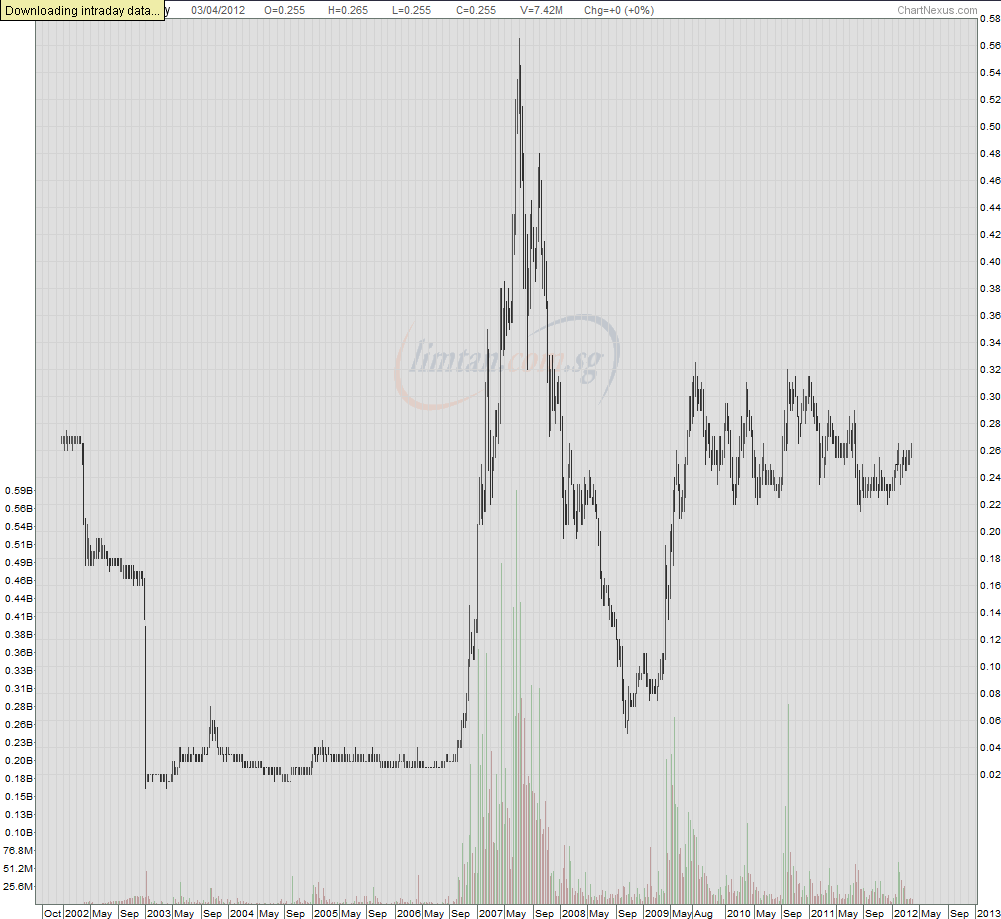

In its deepest draw down, the price fluctuate at $0.02 to $0.03 cents. It would have been a great pickup on the hindsight. Back then, I frequent forums in Fundsupermart a lot and there is one forumer who kept selling what a great play Yongnam was at that price. Well most of us thought his bullish calls was abit looney.

Looking back, most of us just did not have a long enough market experience to realize an experience management beaten down by industry wide problems.

Had you held on to Yong Nam since this was recorded, you would have barely broken even. It will be vastly different had I start at 2003!

As a shareholder, the difficult decision is to subscribe to the rights issue and warrant issue in 2004 at a low price of $0.02 and warrants that can be exercised at $0.03. That would have boosted your number of shares by 75% at a negligible price.

Those rights shares would have net you 1100% gains.

Rights issues do not always work out and at that time it takes some understanding of this companies past and long term thinking to evaluate whether it makes sense.

Speculation Stock

Investing for capital gains make more sense. For the past 9 years, the shareholder returns would have been more rewarding if you sell it at the height of 2007.

Yongnam have only recently starting to pay small dividends, even if you held long. And I believe there isn’t a dividend policy in place.

Various contract wins

The strange thing is that we kept hearing various contract wins from Yongnam every year, but we don’t seem to see much of a share price spikes. What could be the explanation for this?

Are there investors in Yongnam? How has it done for you guys?

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024