They say that once beaten twice shy. However, investors due to greed will time and again revisit failed investments and never learn from them.

I suspect Food Junction is the case for me. I was invested in Food Junction very early in my investment life at 68 cents. I am still holding on to it. What was suppose to be a potentially great dividend stock turn out to be otherwise.

My investment is 67% in the red for food junction. I received 36% in total yield up to now so that cushions the impact. You can take a look at my previous postings of Food Junction here.

I still find this statement from Food Junction’s 2005 Annual Report interesting:

There is no substitute for experience, so be sure to pick Food Junction Group, which has been in the business for more than 12 years now.

How ironic that with so much experience share holders were not only not rewarded but punished for what I thought was a good stake in a business that will grow and prosper.

Potential returns and valuation

Why did I decide to re-look Food Junction again? I think its because I want to see if there is anything that has change that has made this compelling.

Cash holdings: 20.50 mil

Total Assets: 50.18 mil

Total Equity: 31.38 mil

Market Cap: At $0.21, 27.09 mil

Enterprise Value: 6.89 mil

EV/Operating Cash-flow: 0.99 times

Mkt Cap/Operating Cash-flow: 3.9 times

Price to book: 0.86 times

Price to sales: 0.56 times

Free Cash-Flow Yield: 14.5%

Dividend Payout Yield: 3.59%

Judging by the different valuation ratios, it is compelling that we have something cheap here.

Cheap things can continue to remain cheap if the stock does not have a stable operational business or they have an execution problem.

Based on EV/Operating Cash-flow of 0.9 times 2010 cash-flow, Food Junction will just need one year of similar operational condition to earn back what investors put in at current price.

I do find it attractive. But we have to investigate if food junction’s operations.

Management’s execution over the years.

Management Execution

Food junction had a change in management 2 years ago when majority shareholder Auric Pacific took control.

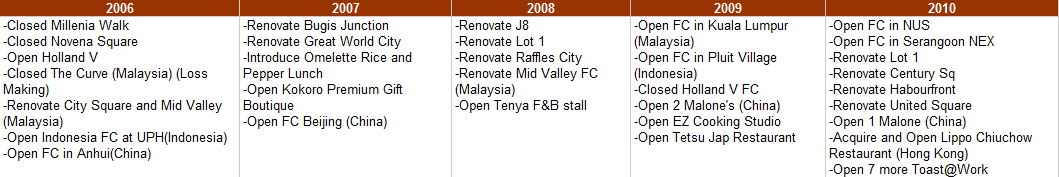

Here is a summary of FJ execution since 2006:

(Click to see larger image)

The strategy seems to be to continuously revamp existing food court to keep up with the times. During this period we are seeing a lot of fresh ideas such as premium gift shops and Japanese restaurants.

While I am no food and beverage expert but the management seem to think that these concept eateries are here to stay in Singapore and should be added to their stable.

I am skeptical of this. For me, I think their set up cost is more but return on investment is much lower than your traditional food court business.

Profit, capital expenditure and return on assets

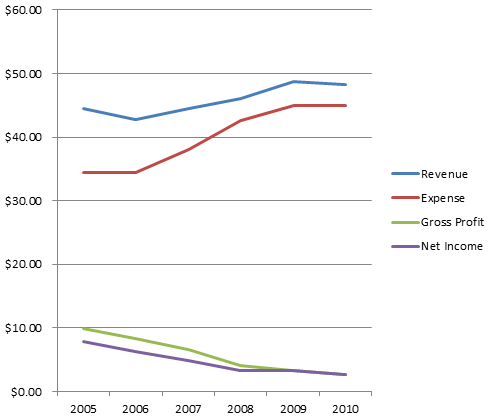

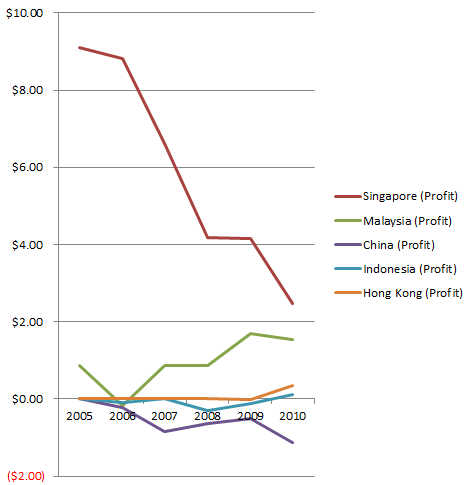

If we look at revenue and profit for food junction since 2006 you would observe that there is a drastic decline.

Not so much for revenue, for it was able to increase at a slow growth rate. Expenses have been creeping up, which is a primary reason why profit declined.

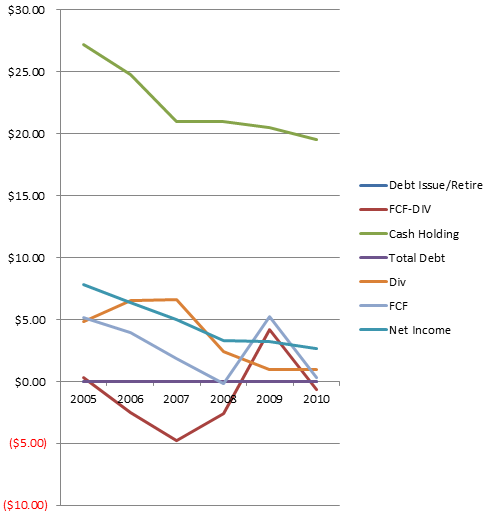

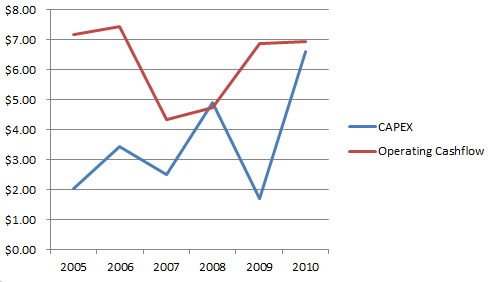

Operating cash-flow continue to remain around 4 mil to 7 mil.

Free cash-flow continue to decline and remain unstable during this period. The early investors like me enjoyed a div payout from 4 mil to 6 mil. That proved to be unsustainable as the company attempt to payout all it’s operating cash-flow.

The result is that free cash-flow net of dividend payout was negative except for 2009 and without taking more debts, food junction was bleeding out it’s sizable cash holdings.

At current dividend payout if 0.9 mil,old investors like me were not getting the yield we were looking for.

When I first purchase it we were looking at higher than 6% yield at 68 cents which is a payout of 4.4 mil.Current yield is around 3.59%.

The management continue to put more money into capital expenditure during this period except in 2009 where in line with the economy recession expenditure was reduced.

If you compare this to the management’s moves, you will observe that there is a large correlation in expenditure and renovation. I suppose that is where most of the capital expenditure go to. No doubt 2010 marks a 5 mil investment in the Hong Kong restaurant.

We will now take a look at the performance of their assets.

Segmental performance

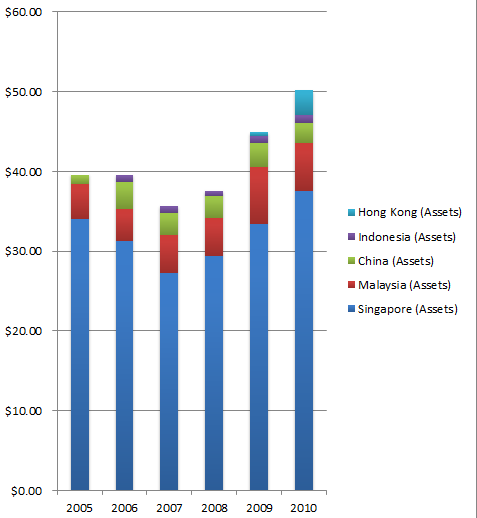

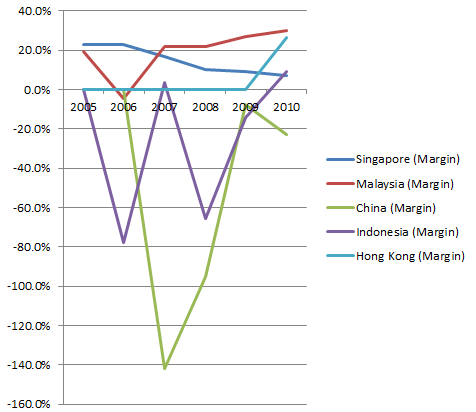

Food junction have been venturing overseas particularly in Malaysia, China, Indonesia.

The results have been bad. Except for Malaysia, all of them didn’t replace the loss income from Singapore operations.

The alarming thing was the drop in profitability for the stable profit generator in Singapore. Was it the competition? Was it the wrong moves made? Was it the increase in expenses?

I believe it is very much due to expenses ballooning. Revenue (not shown here.) have grown but if net profit is falling then it should be the expenses eating into it.

Margins from Singapore operations have fallen due to high expenses and stagnating profits. Margins from Malaysia food court operations have been great.

However, the let down was the Indonesia and china operations. They were never going to be profit contributing.

In the food and beverage industry, what works in one country may not work in other countries because of different cultures , affluence.

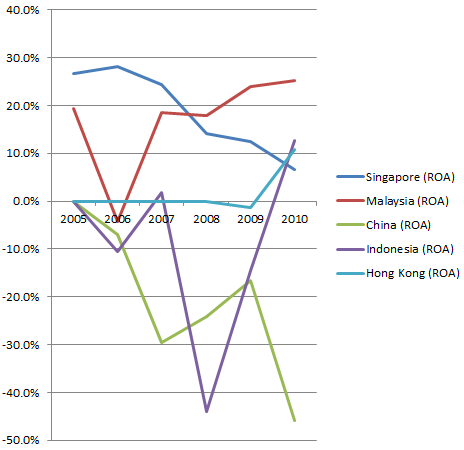

A look at the return of assets of the various operations confirms that overseas execution was detrimental.

It wasn’t just the overseas investments not delivering. Locally, ROA have been declining. The new concept ideas are not doing as well as their old idea. Recent investments.

Conclusion

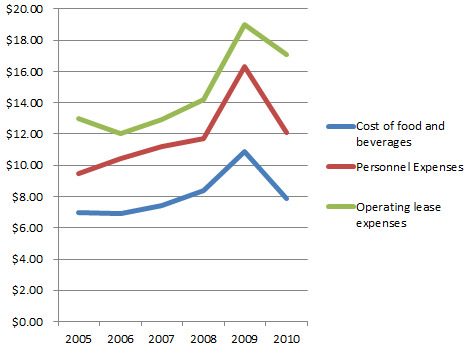

Food Junction is very much a value play. But only if it has issues that the management can turn it around. What do I think is the main issue?

The main issue happens to be operating lease expenses. The rentals for food courts is escalating like mad.

Compare to the start in 2005 its almost 5 mil difference. Rest of the expenses are climbing but the main issue have to be these 3. While personnel expenses are escalating and food prices are also rising it is operating lease that is a problem.

The problem here is that FJ couldn’t price in more margins into their selling price at food court. It is already very high! The more they do that the more people will not eat there.

This is a problem that is difficult to navigate.

Secondly, the business in Indonesia and China don’t seem to be working out well. If the management is good they would know how to address this.

Whether Food Junction becomes a great play will depend a lot on this 2 factors.

The recent opening of 2 food courts could provide us with a good assessment whether FJ is still at the mercy of escalating operating lease cost.

I run a free Singapore Dividend Stock Tracker . It contains Singapore’s top dividend stocks both blue chip and high yield stock that are great for high yield investing. Do follow my Dividend Stock Tracker which is updated nightly here.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

Benjy

Sunday 24th of April 2011

I also noticed that, once the founding member sell out, the dividend yields starts to decline. They should stick to the old concept of opening f/c outlets in HDB town centres.

Drizzt

Sunday 24th of April 2011

Hi Benjy, i seriously doubt that would work. if you notice coffeshops nowadays they don't seem to fare very well. The lease is high. that is a bigproblem for them

isaac

Tuesday 12th of April 2011

I avoid Food Junction/Banquet/Kopitiam etc if i can help it. Cookie cutter food plus so expensive. Only saving grace is they have air con. :)

juno.tay

Monday 11th of April 2011

Hi Drizzt,

My view is that while it may seem a bargain - there are two reasons why you should reconsider investing in even more money.

1) The business doesn't have pricing power. 2) Bad industry to be in (super competitive)

Even if you had the best management in the world, its still hard to compete against those odds (not impossible but hard).

That makes the outcome of the business much more hard to predict.

If thats the case, why not just put your money into a business that represents a more wonderful investment opportunity? :)

AK71

Sunday 10th of April 2011

Hi Drizzt,

Seems like this could become a lemon? Tried to find Food Junction in your pie chart but it's not there. Have you divested?

Drizzt

Sunday 10th of April 2011

its not on my pie chart. i still have it. not entirely a lemon but i wonder why the management couldn't get things done right. mind you a normal FCF yield could be more than 10%. this thing got potential at 0.9 times ev/ebitda