The work posted here shall not be reproduced in full in another site. Please seek my permission if you want to post this.

By Drizzt

Introduction

I was asked during the last 2 months by friends a horde of questions with regards to finance.

- Should i start investing now?

- What should I invest in?

- Do you have an agent that can recommend to buy insurance?

- Which sector is good to invest in?

No doubt the investment fever has really caught on with many. However, I see it as a natural progression that after having quite abit of fun with life after starting out work, its time to think about investing for their future.

My advice is first to recommend that they get their financial house in order, before thinking about all these plan. Some doesn’t want to miss out on the fun in the stock market, while others feels awkward when one doesn’t have any form of insurance.I would prefer that they think about budgeting before they start planning for such things.

I decide to instead be proactive and write about the way I plan my money. To me, its not just about getting right advise about budgeting and money management. What is important is also about setting up your infrastructure to plan, monitor and evaluate.

Many focus too much about the plan and evaluate, without touching on how to monitor. We are seeing alot of good opensource tools that we can use to help us achieve this, and here I will show you how its done.

Why Budget?

Before you can think about investing or buying insurance, you need to think about funding for these 2 items in the long run. Lets just say that buying a whole life policy is not a 1 year 2 year affair. You will be paying for almost 20 years to probably when you are 65 years old (And it can get even longer then that!)

To grasp you can commit long term cash to such items, you will need to have a strategic budgeting plan for your family or your combined disposable income.

Where does budgeting go into your overall plan? In my opinion, it should be done after you setup your Financial Mission Statement and Defining your Goals. When your goals are defined, you

- can then find out if your spending within your means at the moment

- find out how much you can spend to fund your goals

- whether you have existing debts that you will need to clear before some goals can be achieve

Do note that budgeting, like the rest of the items in your financial plan, is something that you need to monitor and change when the need comes. It takes commitment and discipline.

Once you have effectively set out your budget, you can then consider your other immediate needs, namely insurance and investments.

Tools to make your life easy

Right from the start to the end, you would need to take down notes, keep track of simple things on the go and monitor your overall progress. Here I will suggest some good-to-haves so that your planning can be much smoother.

Monitor Goals and Financial Projects

A fan favorite here will be to use the excel sheet. I am ok with any form of note taking. An A5/A4 size note book will be good if you find that writing down makes you remember or think more clearly about things.

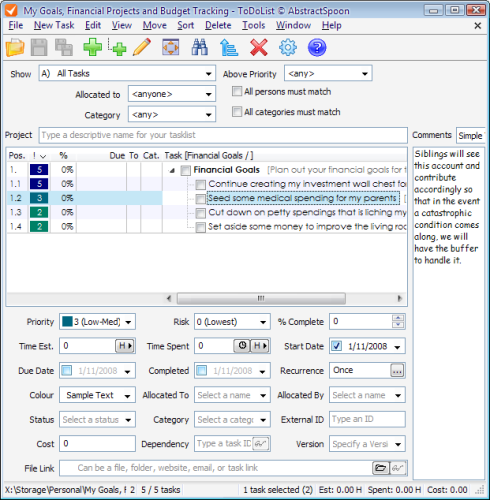

My recommendation will be a freeware task list program called ToDoList. It is one of the best task list developed baring problems with categorizing. However, the sub-tasking capabilities will really be very helpful here and you can install the software in your thumbdrive and monitor on the go (Although its not really needed as you won’t touch this list everyday). [ToDoList Executable download]

Keep track of everyday spending

The objective is to note take anywhere you can. Some rich folks will use their PDA to record. I find that most phone have a note function. That should suffice. I personally recommend a small paper note book that fits in the palm of your hand.

Monitor your accounts

I would advise using a computer software to help you managed your budget. budgeting is information that is not really that crucial to be lost or compromised. So your alternatives will be:

- Offline Applications

- Microsoft Money

- Quicken

- Gnu Cash (Opensource)

- Excel Spreadsheet

- Online Applications

- Mint (free now)

- Wesebe (free now)

- Yodlee (free now)

- Buxfer (free now)

- ClearCheckBook (free now)

Personally, I am using Quicken offline version. Now, I know there are many tech savvy peops who prefer to use a pda software to manage it. However, I do suggest using a desktop client to consolidate your statements and accounts as I have a lot of problems trying to syncrhonise pda accounts with desktop accounts. You wouldn’t want to corrupt your data would you?

I personally think Buxfer is a very good product. It is comprehensive and you can update your accounts if you have access to the internet.

For most of my article i will try to use Buxfer as an example as much as I can.

Your Budget Plan

My plan entails 10 steps. And through the following illustrations I will show you the thoughts and technical aspect of creating a budget plan.

Step 1: Engineer Goals into Financial Projects

Each year, you will have a set of financial goals that you wish to achieve. Some are more pressing then others, some leads to a closer step to financial freedom, while others lead you close to being debt free.

Let’s Plan! : Here I will start a new ToDoList. I will enter my goals into this ToDoList.Then I will prioritize the goals in order of priority using ToDoList’s priority and sorting tools. This is how I kick off my planning.

In my opinion, you will not get things done by merely stating it vaguely what you hope to get at the end of the year. You need to quantify it or break down your goals into smaller projects. If a goal is vaguely defined, you will find it hard to determine how you are going to achieve it.

An example, "I want to be rid of my debt!" This might sound easy to achieve if your debt is 2000 bucks, but if your debt consist of many items such as a $5000 credit card debt, $120,000 mortgage loan, $50,000 car loan. This would be a bit problematic with scarce cash lying around.

Quantify it and Break it down to a financial project.

Goal: "I want to drastically reduce my debt!"

Project: "Reduce at least $3000 dollars of credit card debt this year."

Project: "Payoff $12,0000 in mortgage payment."

Project: "Payoff $3500 in car loans."

This will be much easier to start off because you have a figure to work with! At the end of the year, you will have a figure to see if you managed to do achieve it as well. Another example

Goal: "Upgrade my refrigerator"

Project: "Spend $1400 downwards on a new refrigerator."

Some goals can be translated directly to projects as the one above. Last example:

Goal: "I want to have a health fund for mom and pop"

Project: "Contribute and monitor a joint health fund targeting $3000 dollars this year."

Your projects created might or might not be rational or achievable, but this can be fine tune in a step in the later portion or if its the first time you are doing it, it will be good to monitor how you execute it for one year.

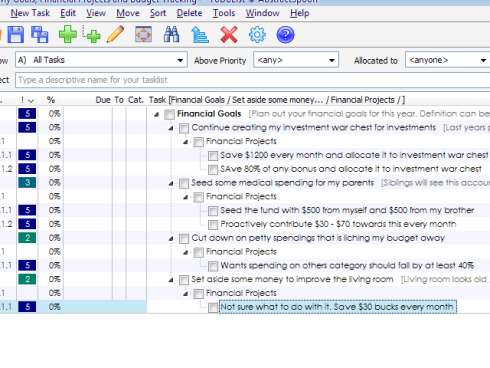

Let’s Plan! : From the Goals listed down in your ToDoList in the previous step, do like what i did in the examples given, break them down and quantify them. These will be your financial projects. Give a quantifiable figure (percentage or dollars).

Under [Goals], Create a subtask called [Financial Projects], then list your financial projects like the example i did.

Step 2: Strategise your spending plan

Ok, we have got our goals and financial projects set up. That takes care of part of your financial scaffolding.

The basic way to go about doing this technically with the help of software like Buxfer or Quicken is to use bucketing strategy. Simply put, all your earnings from business, gifts, and working compensation will go into one main cash account i.e My Main Account.

You will then schedule transfers from this main account into smaller accounts. these will be define based on your spending savings, needs and wants as well as for your debt financing (to be explained below). You will eventually have sub accounts such as Transportation, Investment Warchest, Insurance,Debt Financing,Hobby Spending etc..

Advantages:

- Easier to monitor based on each acct. You will be able to tell when one acct is in the red, indicating problems in anticpating budget or simply overspending and underspending

- Once automatic mechanism is set, transfers need not be manually repeated every month.

- All your cash is putting to work, either earning a better returns, providing subsistence or improving quality of life

Now we need to think about governance to keep in check with our Goals and Projects.

Here we set some rules so that we can achieve this.

Rule 1: {Disposable Income} needs to be greater than {Total Expenses} + {Debt Financing}

Disposable Income – Income that you can spend as cash after any taxes, pension contribution or government force savings.

In Singapore context, that will be your monthly salary less CPF contribution (20% of your salary currently).

Total Expenses – We break this up into 3 categories:{Savings},{Needs} and {Wants}.

- Savings

- Second most important out of the 3. It will help create more wealth for you and save you from emergency situation.

- You should try to maximise this.

- Channel into

- Investment Planning Account

- Marraige Planning Account

- Child Education Planning Account

- Insurance Planning Account

- Emergency Buffer Cash Account

- For more information on Insurance Planning, read up My Insurance Philosophy and Savings and Endowments.

- We will further define these items later

- Needs

- Most Important out of the 3. Without these things, you can’t function efficiently as a human being or as a worker.

- Some items may fall within {Wants} depending on your profession as well. e.g. An IT professional who supports the regional market will need a broadband connection, compare to one housewife who only checks email, which will be a want.

- Channel to

- Groceries

- Transportation

- Meal allowance

- Children Allowance account

- Taxes

- Handphone

- Power Utilities

- Conveyance fees

- We will further define these items later.

- Wants

- Least Important out of the 3. Your quality of life may be affected without this, but it is something you can live without.

- This is the account that you need to try to reined in your temptation to spend on such items.Control your spending on these things.

- Channel to

- IPod

- New Sofa

- 12MBps Broadband Connection

- Wedding Dinner Invitations (Some are needs, some are really wants)

- {too much to name really….}

Within this 3 items, you will need to decide on a projected expense allocation. I strongly advise that:

- Needs: 45% of total

- Wants: 20% of total

- Savings: 35% of total

Personally, because i’m not married and all, my savings can go as high up to 55%. Eventually, as you work longer and income increases, or when you get married, your savings portion and wants portion should increase more than your needs.

As always, maximise your savings portion as soon as you can. It gives you a real sense of confidence and emotional stability compare to Wants, whose confidence and appeal is often short-lived.

When you carry on your planning, think clearly what is a {Need} and what is a {Want}. Often folks find it hard to differentiate between this 2. Do post your queries to me if you have problems differentiating between these 2.

Rule 2: Clear the smallest debt first

The most difficult job for any folks with debt is to manage a debt situation. An average Singaporean couple should be saddled with mortgage debt. Car ownership is getting easier with lower COE prices and loose credit.

For some, you might be in an unfortunate situation of accumulating alot of debt. I don’t have this problem right now, but for me your debts can be broken down to these few categories:

I find that paying off the smallest debt, instead of paying off the highest interest debt first works better. This is because if paying off bad debts and huge debts is one of your priorities, you would want to see results.

Emotionally, it makes sense, as paying off small debts enables you to see that your debt is shrinking. So to further define my rule, pay off the smallest and highest interest debt i.e. small sum credit card debts. Then follow by small and low interest debt. If you pay off the first small debt in a week, you mark it off the list. Scratch one! Then you knock off another and another. You get emotionally fired up to knock out all of the debt. And if you are using the debt snowball, you are adding more and more money to each debt, and you are debt free before you know it.

Rule 3: Your disposable income used to service debt > then minimum sum of all your debt

From Rule 1, your income should contribute to expenses or debt-financing. You should decide on how much you want to commit to servicing debt. My advice is to be larger than your total minimum payment.

So lets say you have the following debt:

- $67,000 mortgage loan with a monthly "minimum" payment of $350

- $1200 credit with a monthly minimum of $50

- $2000 credit with a monthly minimum of $50

The total minimum is $450 a month

Your disposable income is $1300 a month

The minimum is 34% of your disposable income. A good advice is that your total debt financing to be greater than this amount and more.

As Rule no 2, re-arrange your debt according to smallest to largest:

- $1200 credit with a monthly minimum of $50

- $2000 credit with a monthly minimum of $50

- $67,000 mortgage loan with a monthly "minimum" payment of $350

If you have allocated 50% of your D Income to payment, or $650, your extra after your minimum will be 650-450 = 200.

Use this 200 to pay of the $1200, together with your $50 minimum. Once you clear that debt, the 250 from the first item will add to the payment for the $2000 and so forth.

They actually have a name for this method of paying off debt which is Debt-Snowball Method. You can read more about it here.

[Which debt should you pay off first?]

Remember! while you are doing this, stop yourself from gathering more small debts! gathering many small debts will pile up and emotionally you might disrupt from successfully paying off in the long run.

When it comes to the bigger debt, most of these are regular financing. Which means the aim is to keep up with payment. At some point down the road, when you are in a good financial situation, you might want to refinance your debt, to either get a better interest rate, or simply with the aim of reducing your debt one shot at a time.

Now that you thought through how to do it, a summary of my recommendation is as follows:

Do note that your expenses to debt-financing allocation will vary depending on your goals. If clearing debt is one of it, you might want to allocate more towards it.

Eventually:

- Your income grows

- Your % in needs falls

- Your Savings increase

- Your debts become lesser

This is where you will end up:

Let’s Plan! : Here we will list our disposable income and the percentage allocated to expenses and debt financing into your note that you wrote down your Goals and Financial projects.

The good thing about ToDoList is that it enables you to create a tree structure about notes, which is always a better way to view and plan things. However, you can always rely on your trusty paper planner for this.

As you can see here, I have minimise the Financial Goals and created {Financial Strategy Planning}.

List out your combined disposable income. Now how do I do the $2000 bracket thingy? if you input it in the comments section, ToDoList will append part of it behind.

Next, fix your ratio of expense to debt financing. I put an example here of 60:40. If your goal or financial project includes clearing massive debt, you might wanna allocate more to it.

From your percentage allocated to expenses, decide on your ratio of Savings:Needs:Wants. You can then set the priority on the left to visualise better. Don’t worry if your arbitrary figure cannot be accomodated, you can always revise it 2 steps later. Planning needs to be flexible and realistic.

ToDoList enables you to set priority from 1 to 10 and none.Set those that you need to prioritise and those that you do not.

Next, we do the debt-financing.

List out your outstanding loans that you need to finance. Append the minimum payment sum in the title instead of the comments section.

Calculate your "Extra Cash after total minimum" by taking e.g. $800 – $350 – $50 – $50 = $350.

You will need to rank them as well. Use the priority to rank the debt you want to clear first. According to what is listed here, it is the smallest and highest interest to the biggest and lowest interest.

In the comments of the first loan to clear, append a "Next to clear!" to the comments so that you are aware that:

- You will clear this loan next

- Allocate your extra allocated to debt financing ($350 here) to repaying this loan.

Step 3: Create an audit trail of your spending pattern

Before we put categories or create spending accounts, we will need to take note of the things that you spend on. This will involve taking down what you buy and spend everyday. This is where your small note book comes in. It’s actually very easy:

- Taxi – $15.40

- Lunch – $3.40

- Bus – $1.76

- Lime magazine – $5.00

After 1 or 2 months, depending on how long you can do this, you have a rough idea what items you spend on and so forth can categorize them.

Do note: Track your income and gifts as well!

Step 4: Categorize your spending

With the audit report, you can break it down to categories and sub-categories. Why do you need this? So that monthly, quarterly and annually, you can track your expenses and be clear if you are following it.

Lets Plan!: Most of today’s financial software have a starting list of categories. You may or may not agree with them. They might not suit you, so for some you can make adjustments to them. For Buxfer, its abit special. They use Tags, and it somewhat works as if categories. you can create sub-tags as well.

Step 5: Categorizing your needs

Your spending are not the only items you need to categorize. There will be items that you will missed out, or that you are projected to have in the future.

The best way to find these are from your Financial Projects defined in Step 1.

Lets Plan!: Do the same as the step before.

Step 6: Create a Main account

I’m sure most of you will have many bank accounts for savings. It is best that we view them as one huge account. The main reason is that, based on our strategy, we will be dividing them into sub accounts that are objective to our spending and financial patterns.

Lets Plan!: Although Buxfer has a main account called Wallet, I decided to rename it Main Cash Account. So whether how many savings account I have i will aggregate it here. If you think you can still visualize and represent well with 2 to 3 accounts then by all means leave it as that.

Step 7: Creating your Sub Spending Account

As i have illustrated here, having these sub-spending account enables you to monitor your usage and to see whether you have sufficient funds to pay certain bills.

Now, not all of your categories will become a sub-spending account. Most of the time, only your main categories will become of that. I tend to put spending accounts for my Financial Projects and rather long term items such as Household improvements, Medical Accounts and Parent Contribution.

Lets Plan!: Here what I did is to create a few examples of virtual sub-spending accounts. Its ok for them to be unfunded now (if it is, just input the starting amount.) At the next step, we will see how to address that.

Step 8: Schedule Transfers to automate the system

We have the main account, we have the virtual sub-spending accounts. So now we shall funnel our revenues into these accounts. Based on my strategy, you should funnel almost all your cash to these virtual accounts. I normally leave some small items like transportation and meals in the main accounts.

Lets Plan!: When should you funnel them in? It would be during your pay day. This is when you get the most positive increase in your Main Account. On that same day you will schedule transactions to the respective accounts. You can either do it manually, or if you can find a good software that takes care of this aspect, it will be even better.

Buxfer can schedule reminders, but that is all that it can do. I have no way of making it automate this portion. This is one of its greatest failing points, since you will have to manually input alot on your pay day.

In comparison, tools like Quicken enables you to plan the transactions, reminds you as well as translate it to actual records in the acct.

Step 9: Adding Transactions and more transactions

Once you get to this point, you will have a pretty decent idea what you should be doing here. Each day, you will spend your money on a few items.

Record them down in a small notebook or a PDA. To some it might be troublesome but i don’t think so. How much can you really spend in one day normally??? I know there are days when you spend alot. Just keep those receipts in the notebook.

A normal day’s spending would be something like this:

- Transport – $1.78

- Meals – $7.80

- Groceries – $28.90

That ain’t alot of things to remember. Sometimes I do forget to update at the end of the day but using a small notebook is a good system since it also enables you to be wary of your spending each time you put it in your small notebook.

Step 10: Reviewing your progress

It is not enough to record down your spendings and income this way. The main purpose is to observe that you take each small steps towards your Goals and fulfill each projects.

I recommend a small review at the start of every month. Things to watch out for:

- Have you kept to your strategy allocation of Needs, Wants and Savings? If you have then good for you. If you haven’t then its a reminder for the next month

- Some virtual sub-spending accounts will show negative. This is an indication of spending more than budgeted. Should you cut back? Probably but sometimes we do underestimate the necessary amount due to our in-experience. So probably there is a need to refine the allocation.

- Some things such as Gift Account will only temperory be negative since you won’t be giving gifts every month. For these accounts, you will use the next few month’s contribution to this account to "repay" the deficit. Humans tend to take negative things pretty badly, thus it will create the momentum to refine it.

Annual review is more special. This is when you observed if the past year you had put in the right financial discipline.

Go back to the ToDoList that you created at the start of the year. Look at each of the Financial Projects and see if you have achieve it. Since your projects are quantifiable targets, it will be easier than a goal to see if you are above or under achieved.

When you look at the past year’s data, you might discover some things that you never knew about the way you spend your money. For example, I knew i spent alot on medical. But when i see the annual figure, it really hit me that i should do something about it.

Some items no matter how much you cut down, will be useless if you are spending on items that take away a chunk of your networth. These are something to think about when you evaluate next year’s Goals and Financial Projects.

I will talk about these in my other postings.

Conclusion

I hope every one will benefit from this. Creating a budget is often described elsewhere as a few easy steps. But to actually figure out how to create, maintain one is rare.

I hope folks exhibit the same kind of vigor to maintain your budget. Like anything else, practice normally makes perfect.

The work posted here shall not be reproduced in full in another site. Please seek my permission if you want to post this.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

capturedthought

Monday 14th of March 2011

hi i cant download the todolist anyway ard it?

Drizzt

Tuesday 15th of March 2011

hi capturedthought, you can download it here >> http://abstractspoon.pbwiki.com/f/todolist_exe.zip

Lvnv Funding

Tuesday 7th of December 2010

I prefer the debt snowball practice, specifically precisely how Dave Ramsey advocates accomplishing it. If you are talking to the public like Ramsay, something every person does not have is certainly motivation. Most of the people must be motivated to keep proceeding, therefore begin with the littlest debt and repay it first.

Drizzt

Wednesday 8th of December 2010

essentially i learn quite a fair bit from Dave Ramsey as well and do agree that clearing debts is most of a time pshychological thus it makes sense to clear the easiest first.

yyt

Wednesday 20th of October 2010

hey, thanx drizzt. :)

Surprisingly, qif format is an open "tag-based" representation of transactions and bank accounts. Rare move by microsoft, haha http://en.wikipedia.org/wiki/Quicken_Interchange_Format

I've finished my simple web-based parser, it's however limited to

POSB(acct), UOB(CC&acct)and SCB(CC&acct).

For those interested you may just email me at [email protected]

Still, the long-term soln would be local banks to provide a better service and provide at least qif file export option for online users. Certainly, this will differentiate their online platform from others.

Quicken to iBank conversion, it's proven on iBank 3.x, but some are experiencing problems when doing so on iBank4...so, backup 1st before you try.

For a Mac equivalent of the To-Do list, "Things" would be pretty close bet, syncs with the iPhone too.

yyt

Tuesday 19th of October 2010

My expense tracking system actually involves 3 parts

1. Download statement in csv format from Bank 2. Parse csv into qif format 3. Import into iBank4

iBank integrates perfectly with citibank accts, so it takes 2 mins from website to iBank. I'm guessing for US banks, most of them provide this service.

For the local and non-US banks, I'm currently working on a custom parser to parses the csv files from the different banks and writes them into qif format.

So once the setup is done, it should take less than 15 mins to enter all monthly bank transactions automatically into iBank. Another 30 mins will be needed to sort out the transactions into their categories.

I reckon it'll take me 3 weeks to complete my setup. I'm into week 2 currently.

I'll rate the current as system efficient enough to fulfill my needs. I was using excel previously, and compared to iBank, it is really very primitive and cumbersome. So i strongly recommend others to try out the off-the-shelf financial softwares available.

Tip : If you have some background in accounting, you can add in additional categories such as Account Payables/Receivables to track $$ owe to/by friends. To me, these are the hardest to keep in check.

Drizzt

Tuesday 19th of October 2010

Wow yyt!

i think what you did is very impressive. QIF format is the format for Quicken and alot of people would benefit from it if you are willing to share with them lol.

i hope you come up with it and helps you.

i dun usually account for accoutn payables and receivables. i put it in my To-Do list app to remind me these buggers owe me money.

i wonder if i can import 7 years of quicken data into iBank.

yyt

Saturday 16th of October 2010

For Mac users, guys might wanna try iBank, Moneywell, Quicken for Mac to track your bank accounts.

Personally I'm on iBank. It also an app for your iPhone to track your expenses on the go. You can then sync it with the program when you're back homoe. Haven't tried that yet though...haha, not on an iPhone yet

My tracking involves exporting all my monthly bank statements into either OFX or CSV formats, then import them into iBank. iBanks can then "learn" frequent transactions and categories them automatically :) this is what I like haha.

Some additional notes regarding exporting bank accts/Credit card statements from local bank:

Citi accts/CC - variety of formats OFX, csv, qif, etc DBS accts - only csv format UOB accts/CC - csv, BUT with a .xls extension SCB accts/CC - csv and pdf format

I believe citi has the best online platform out there so far. Formatting is consistent and most imptly the data is easily exported with inter-operability high on their minds. You can easily import their data to any financial softwares.

DBS and SCBs are not that bad, at least they standardize their export formatting (i.e. CC statements and Savings statements looks relatively the same).

UOB can really really work on thier online platform. The exported data for Accounts and Credit Cards are formated so differently, which is a pain in the *** when you try to parse it.

Haha, so hope this helps in the audit trail too for pple on the Mac.

Drizzt

Sunday 17th of October 2010

Hi Yong tai,

Thanks for sharing. Those are really good information on local bank statements.It will be really great to hear your experience with iBank, its pros and its peeves.

Every budget software i feel have a bad point. for me Quicken is its format. but then its so big that most US banks offer it. only local bank doesn't.

How would you rate your system? do you find it a chore to enter transactions and how long it takes you to set it up?