CH Offshore is an offshore ship services company for the oil and gas industry. I knew about CH Offshore since it was spinned off from Chuan Hup and recently took notice due to the price drawdown and the enlarged dividend yield.

The business is easy to understand. CH Offshore charters anchor handling tug supply vessels (AHTS) to oil and gas exploration companies that have oil rigs that needs to be supported by these boats.

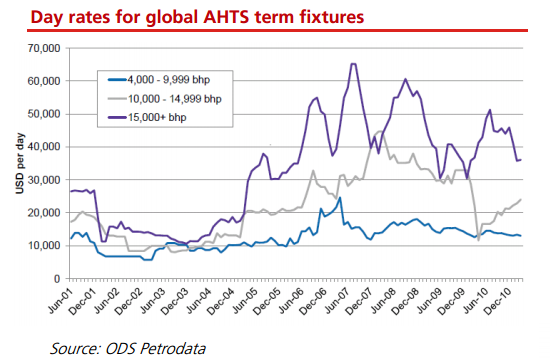

AHTS Downturn

The demand for AHTS vehicles have been in the funk since the GFC and have not posted much improvement. Buying in right now would be buying in near the bottom of the AHTS charter rate cycle.

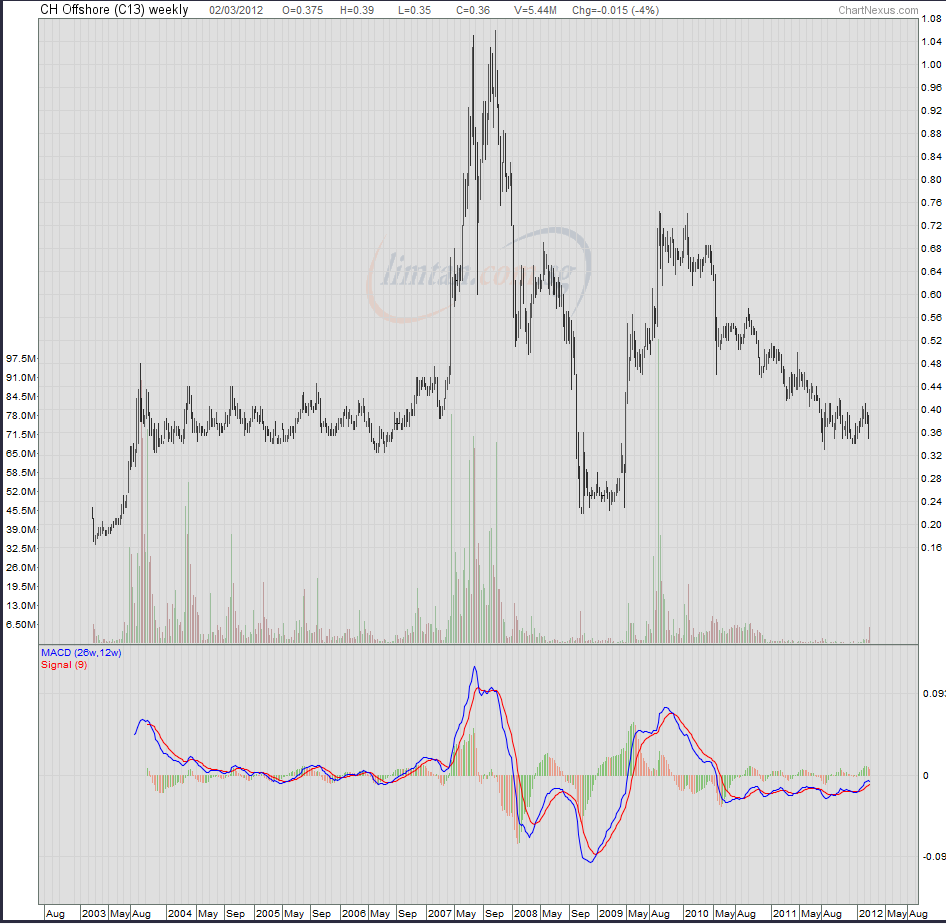

Share price have fallen from the good days and if you are a believer that the offshore oil and gas exploration industry is here to stay and there is a demand for AHTS ships, this is a good time to accumulate.

Prices currently is at 10 year historical median prices.

Long Operating Track Record

CH Offshore has a long and established track record in the oil and gas industry, dating back to the 1970s in Indonesia, under the Chuan Hup group. It has a solid execution track record and strong working relationships with its customers, including oil majors like ExxonMobil and Shell, and national oil companies like Saudi Aramco, and Petronas.

Assets Revamped

CH Offshore have spent the past few years undertaking extensive revamp of their portfolio of ships, They used to own 24 AHTS but at the end of 2009 they have disposed of all its pre 1980 built vessels. These boats were sold after fully depreciated, so it presents a good deal to CH Offshore in that they have fully utilized them yet was able to still sell them for a tidy profit.

CH Offshore currently manages a fleet of 15 AHTS vessels. 10 of them are wholly owned with an average age of 5 years old.

7 of the AHTS vessels are 12,240 bhp AHTS vessels while the rest are 5,000 bhp AHTS vessels.

You can observe that the larger vessels were able to sustain a higher charter rates.Since CH Offshore ships are likely to fetch lower charter rates.

We do however are looking forward to a pick up in rates. While rates have failed to pick up, CH Offshore are well managed and are able to earn a good gross margin such that if rates do not pick up, the profits should be adequate to compensate for shareholders.

The advantage of younger fleet

CH Offshore boasts a young offshore support fleet versus the industry average age of 17 years. It is believed that this is a significant competitive advantage as the continued delivery of newbuilds from the yards into an already saturated market enable end users to choose from a wider pool of available assets, favoring younger, more reliable tonnage and resulting in the idling of old tonnage ( 20 years and older).

Older assets present a greater possibility for equipment failure which could compromise safety during oprations offshore. Younger vessels, on the other hand are less prone to technical issues which can lead to costly vessel downtime and high maintenance and repair costs, hence translating to high efficency and utilisation rates for both the vessel owner and charterer.

Deep water capable assets

7 out of the 15 vessels are deep water capable, this would allow them to leverage on the broader industry trend which is gravitating towards E&P activities in deeper waters and harsher environments.

CH Offshore focusing on Indonesia

In FY2011, CH Offshore sold 3 5000 bhp AHTS to its 49% owned Indonesian associate, PT Bahtera Nusantara.

This move allow the vessels to be converted to Indonesian flag, so as to comply with the Indonesian carbotage law and operate in Indonesian waters.

As this is a protected market, vessels that qualify to operate in this region are generally able to command significantly higher rates, estimated at a 50-60% premium to the international rates.

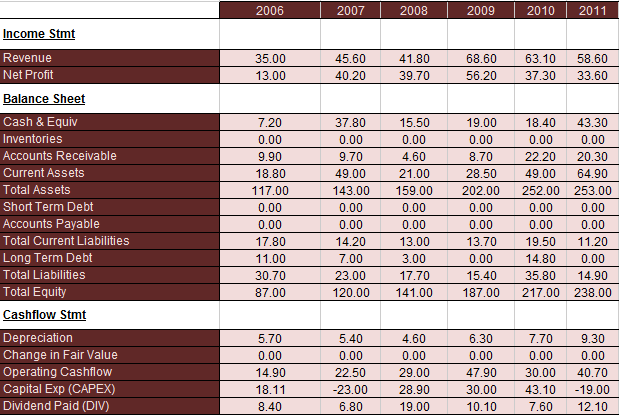

Very robust balance sheet

What we like about CH Offshore is that they are very conservative in their management to balance the books.

Since 2006 their balance sheet have limit debts held to less than 10% of their total assets. While leverage provides the spurt in growth to reward share holders, it does pose problems.

We seen how interest expense have severely reduce the dividend payout of shipping trusts, CH Offshore currently do not carry any debts.

On top of it they have a net cash of 43 mil. Cash as a % of assets is at 17%. Cash as a % of market capitalization is at 16.6%.

Profitable for the past six years

Since 2003, CH Offshore have been net profitable. Due to the revamp of their assets, free cash flow have been lumpy. However, they have been conservative in their usage of cash, paying off debts, purchasing new ships and providing adequate dividend payouts.

Capital Expenditure

CH Offshore in the past three years have carried out major capital expenditure to overhaul its fleet.

The end result is that the average age of its fleet to be 6 years old going into FY2012.

The great thing is that they took the conservative approach to fund it using cash or debts, which have since been repaid.

As such the forecasted capital expenditure for maintenance of fleet per year is estimated to be around 4-5 mil per year. Now we do not know whether they will always stay this way, but it is likely that should management see a pick up in the industry they may aggressively purchase more ships which means higher capital expenditure.

However, I do anticipate a low capex for the near future.

Dividend Policy and Dividend Payout

While CHO does not have a formal dividend policy, we note that since its IPO in 2003, CHO’s annual recurring dividend payout ratio (i.e. ex special dividends vs. recurring net profit) has hovered around or above 50%, with the exception of

FY09/10, which fell to 20-22%.

This was due to 1) higher recurring earnings base in FY09/10 compared to previous

years; and 2) omission of interim dividend in FY10 to conserve cash amid the credit crunch and outstanding vessel capex commitments.

Indeed, CHO has reverted to a payout ratio more consistent with pre-FY09, with a 47% payout in FY11, or a DPS of 2.75 Scts. With its large cash horde, steady free cash flows, and absence of any significant capex programme, we believe it can at least maintain an annual dividend payout of 2.75 Scts per share, or a yield of 7.6% at current price levels.

CH Offshore’s ability to payout $0.0275 dividend per share looks sustainable. To pay that out they would require 19.5 mil. Earnings last is 33 mil which translates to 57% payout.

Due to their fleet revamp, and thus higher depreciation, and forecast lower capex, they should have ample free cash flow to pay out a 60% payout of free cash flow.

This leaves adequate cash to be retain and use to purchase more vessels.

A more conservative estimate is a $16 mil payout, translating to $0.022. At current price the yield will be 6.2%

CH Offshore’s Total Return

I placed CH Offshore’s total return since 2003 in my spreadsheet.

(Click to view larger image)

Since 2003, CH Offshore have provided dividend payouts every year. This does not mean that every year dividend have been growing. In 2010, the management made a decision to payout less so as to focus on vessel purchase.

An annualized return of 10% for the past 9 years look very respectable.

You can see that their interim dividend grew from $0.005 to $0.0075 and the final dividend grew from $0.01 to $0.015 to currently $0.020.

We can only hope that the payouts keep growing with better earnings.

Conclusion

Catching CH Offshore now is good because, this stock pays you well to wait for the good times to return. The risk would be that spot rates for charters may be negatively affected.

However, with its robust balance sheet, the company looks geared to take advantage when the rates improve.

If I get invested, what attracts me would be a sustainable recurring 6% base dividend yield in difficult time with special dividend payout when the situation gets better. You can also look forward to potential capital appreciation during the cycle pickup.

CH Offshore goes ex dividend next Tuesday so we may even be able to pick up this well run company at a slightly cheaper price.

I run a free Singapore Dividend Stock Tracker . It contains Singapore’s top dividend stocks both blue chip and high yield stock that are great for high yield investing. Do follow my Dividend Stock Tracker which is updated nightly here.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

evan

Sunday 11th of March 2012

hi, the price drop sharply since 2010....any reasons behind?

Drizzt

Monday 12th of March 2012

hi evan, it is likely due to the offshore slowdown which affects most ships.

Createwealth8888

Sunday 4th of March 2012

Agreed with your observation at 0.33

Drizzt

Sunday 4th of March 2012

Hi Uncle, i don't think it will be very useful since its not the usual liquid stock that you trade.

The important thing is valuation and it has not veered far from its historical median 0.36 price.

From its history since 2003, there are 3 bands that looks important $0.33,$0.39 and $0.42. The long term support looks to be at $0.33 and where you can accumulate. Anything below that and if there isn't much change in fundamentals it should be a good opportunity. Should it break above $0.39 we could have something good there.

What is your take on this uncle?

freedom

Sunday 4th of March 2012

do you feel its trade receivable is a bit alarming?

1H2012 revenue 26.236, but trade receivable 28,411.

all revenue in 1H2012 was not collected, making days of receivable more than 180 days.

Createwealth8888

Sunday 4th of March 2012

How about posting a chart analysis?