Here is a sweet and short checklist to how to think about market crashes.

1. Everyone is going to tell you different things. Everyone’s experience is colored by how long they have been in the market. The young investors only seen a 2% fall in 1-day period and they called this a crash. The experience folks saw days of 5-6% fall in the index price in 1 day.

Don’t trust their definition. Be quantitative.

Most of the time the definition people gave matter less.

2. Price falls feels like the start of a large crash or just a small correction or just a blip. The truth is that whether it is a one-day big price fall, a 5-day big price fall, or a 1-month big price fall, this might be

- At the start of a very poor year

- The end of a significant correction

- Just a blip

Markets are positively skewed most of the time.

#2 and #3 are more common than #1.

But a lot of people plan with #1 in mind.

Experience has shown us that we will only know in hindsight. It will be hard for you to base your decision making just on price fall alone.

3. The People that are Most Hurt are the Folks Who do Not Have a Plan, to Begin with, or sold a Pretty Poor Plan. Some wealth builders listen to only part of their friend’s plan, listen fully to their friend’s incomplete plan. They might have a less than refined plan.

They will only discover the plans faulty nature against situations like these. We all cannot have a perfect plan but we just have to strive to improve along the way.

4. Respect both the Financial Plan and the Investment Plan. A lot of wealth builders muddle both of these together and it confuses them. For most of us, we can visualize that we are both a financial adviser and an investment manager rolled into one.

If you cannot segregate the roles and responsibilities between the two, it is going to be a problem.

First, ensure you taken care of the financial planning part.

Have enough liquidity (emergency fund) because you might lose your job for those with equity-like jobs and not bond-like jobs (private high paying and market-linked versus civil servant)

Next, how much volatility that your investments can take is usually linked to how far away are you from your investment goal.

If you would still need a long time to reach where you wish to get to, you can have a lot of equity exposure (which usually comes with a lot of volatility).

However, if you have made your money, it is enough for financial independence, perhaps it is wise to balance equity and bond exposure to reduce the volatility.

I wrote about how traditional equity and bond allocation can keep wealth-builders with different time frames in the game here.

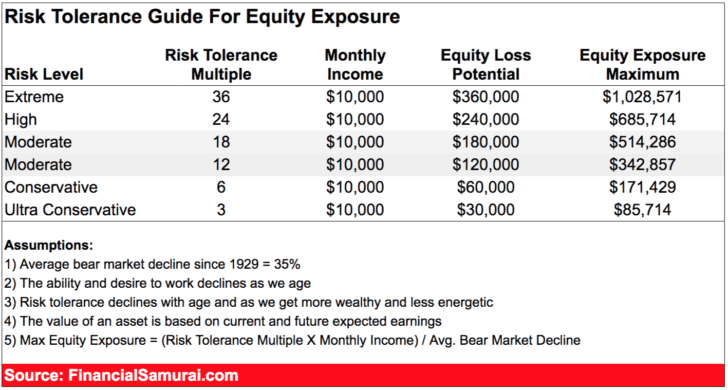

Here is another good article I have written about how to sleep better at night by controlling your equity and bond exposure based on your work income and net worth.

A Metric to Determine Your Maximum Equity Exposure versus your Current Income

5. The People that are Most Hurt are the Folks Who Only Wait for the Correction to Come and Then Invest. These folks usually wait for the correction. When the correction comes, they don’t know what to buy. They don’t dare to buy because this could be the start of a seriously big bear. They can scoop up at better prices.

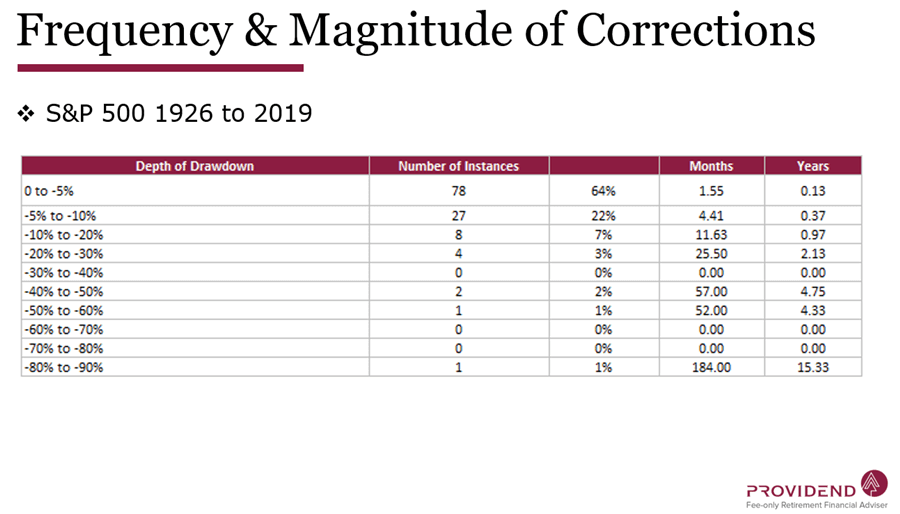

The slide above is from one of our coaching slide deck to our clients. It shows the length, size, and frequency of the drawdowns on the S&P 500’s 93-year history.

64% of those corrections are between 0 to -5%, last for 1.55 months. 22% are between -5% to -10% and last for 4.41 months on average. Then there are the outliers. But 86% of the time the corrections are less than 10%.

Every correction to these folks feels like those greater than -10%. But they will wait for it to get to -20%.

They will never invest because they didn’t see the slide above.

They will never invest because they will just keep waiting. Most of the time, they will invest at higher prices.

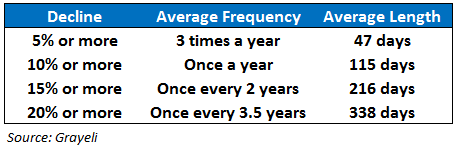

Here is another one (Difference between a crash and a correction)

6. Review Your Existing Holdings to Hold Keepers, Add Gems and Sell Speculations. This point is more for the individual stock investors. The first thing is to make sure that these are the sound companies you would wish to hold going forward.

If not sell it.

Don’t just evaluate based price falls. Everything is going to get ugly at some point. Even great companies.

Do you know how to evaluate your holdings? If not, you are not doing it right. You have not picked up investing & portfolio management competencies.

You need to pick up a lot of books, become a student of fundamental investing.

7. If you have Lump Sums of cash to invest, have a Sound Plan to Invest Over Different Levels of Price Fall. When all this ends, most folks will still be not invested (See #5). They will wait and wait.

Morgan Housel wrote some time ago his plan for such drops. It doesn’t work for everyone but I think it works well after I showed you the magnitude, frequency of price falls.

The idea is that the fall should represent a meaningfully large enough magnitude, but the frequency should not be too rare.

Thus the majority of your money (approximately 60%), if you wish to wait, should be in when the fall is 25%.

The rest should be stagger in some ways such that for each 10% fall, you get invested. A lot of the times, this “the rest” never gets invested (this is a problem. It means a lot will sit on cash unless they get past this psychological hurdle)

The above plan is more for the passive, low-cost, index investors.

8. Know your Investment Plan as an Individual Investor. A lot of investors get very freaky because, in a good market, the volatility tends to look “within your control”. It lures the investors into thinking it is OK to have very large positions.

Some companies have weak fundamentals. When times are good, they aren’t so exposed. But the smart money in these companies KNOW their plan. They are speculating on something short term. When there are signs of trouble the smart money will be out.

You are playing a different game (or for some they have no idea what game they are playing!) and are shocked by the drawdown and not sure what you are doing.

Those with very concentrated positions get very exposed and they do not know whether to hold or to sell. It is a sign of not knowing your game plan beforehand.

When investing in a single company I always have an idea at this point, this single stock or asset is a :

- Pseudo bond. It is fairly valued and I am keeping for the yield

- Quality business. Good long term competitive edge and management and a keeper

- Not so cheap businesses that have a good upside story. This could turned out to be a speculation or might morph into something good

- Pure speculative.

The decision point for each of these are different. For some of this micro-strategy, it is to hold, to add more. For some is to sell-off.

Before entering an investment, have this in mind.

Two articles I have written which elaborate on this:

- How to have more Conviction in your Active Stock Investing

- Execution, Position Sizing, and Financially Irresponsible Stock Positions

9. Let value lead your Individual Stock Evaluation. Individual stock investors should evaluate your companies based on value. Do not fall for the sunk cost fallacy.

A good question to ask is whether if you have not bought your stock, would you buy it today? The answer will let you know the quality of the stock you are holding in your eyes. Of course, there are folks who feel like they should own nothing. Either you do not have adequate competence in evaluation or that the quality of all your stocks are poor.

For all individual stocks, at the end of the day is the price you pay for value. If you are competent to derive the value, you will have a high conviction to hold even if it goes down further. If you are not confident in how you derive value, then you will have low conviction to hold.

Here is an article I have written on Distress Dividend Stock Buying.

This article was first written in Apr 2014.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024